Companies with a positive cash flow have more money coming in than they are spending. However, cash flow alone can sometimes provide a deceptive picture of a company’s financial health, so it is often used in conjunction with other data. Free cash flow is the money left over after a company pays for its operating expenses and any capital expenditures. Free cash flow is considered an important measure of a company’s profitability and financial health. To effectively evaluate the advantages and limitations of conventional cash flow analysis, familiarize yourself with its benefits and the challenges it presents.

- In these cases, calculating an accurate present value may require advanced financial modeling techniques.

- Simply computing a project’s NPV and IRR to determine which of several projects to undertake is not always as straightforward.

- Assume that a homeowner has taken mortgage amounting to $300,000 to be repaid at a fixed interest rate of 5% for 30 years.

Which of these is most important for your financial advisor to have?

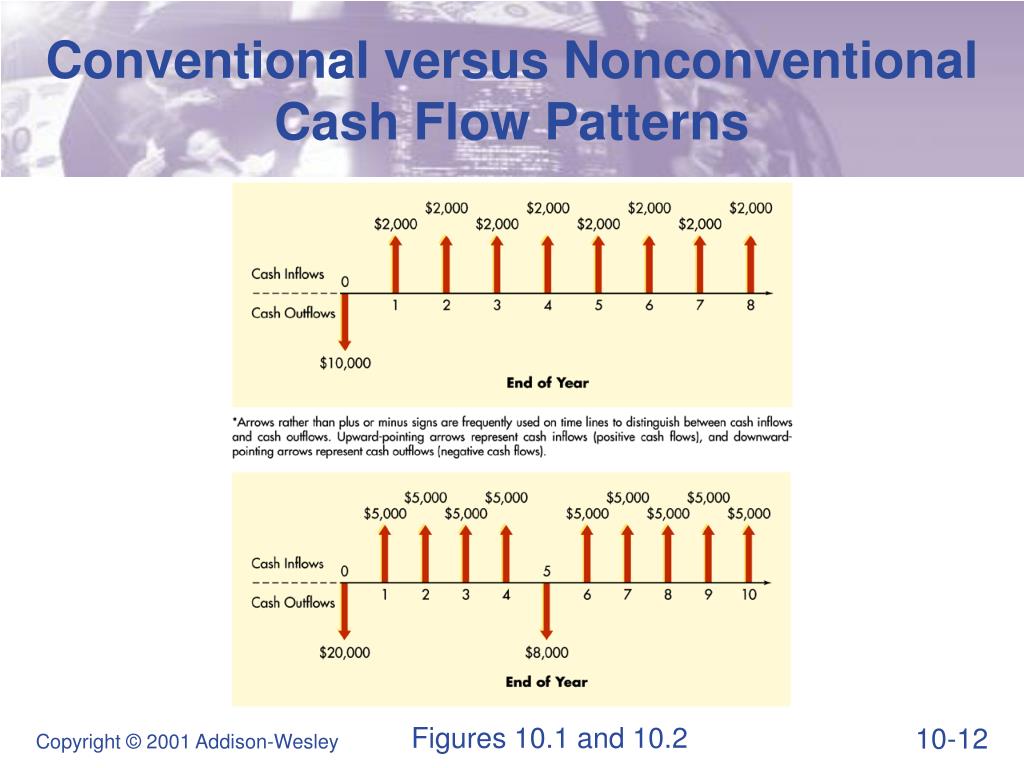

By using conventional cash flow analysis, we can simplify the cash flow pattern of our projects and evaluate them based on their profitability, feasibility, and risk. Conventional cash flow is a series of inward and outward cash flows over time in which there is only one change in the cash flow direction. A conventional cash flow for a project or investment is typically structured as an initial outlay or outflow, followed by a number of inflows over a period of time.

Comparison of the Two Methods

Other measures include the payback period, discounted payback period, average accounting rate of return (AAR), and the profitability index (PI). Unconventional cash flow, as noted above, is characterized by a series of cash flows in different directions. This creates multiple different IRRs, which makes it more difficult for an analyst to value such a company. Once determined, IRRs are compared to the company’s hurdle rate or to the lowest possible return rate of a project. Companies use PV in capital budgeting decisions to evaluate the profitability of potential projects or investments.

Conventional Cash Flow Overview, Formula, Example

On top of that, non-monetary costs and benefits aren’t taken into account. Things like environmental and social impacts that might have long-term effects on a company’s reputation and profits are missed. Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success. Ten years later, Tyler took a part of the money for his first child’s tuition and left the remaining amount in the fund.

How to Identify and Classify Cash Inflows and Outflows?

Therefore, if projects are mutually exclusive, the NPV method should be applied. Capital budgeting analysts make an extraordinary effort to detail precisely when cash flows occur. Again, cash flow simply describes the flow of cash into and out of a company. Profit is the amount of money the company has left after subtracting its expenses from its revenues. Cash flow from financing activities provides investors with insight into a company’s financial strength and how well its capital structure is managed.

Calculate NOI & use capitalization or discounting future cash flows using IRR to assess if investment is viable. Risk evaluation is important, economic downturns can affect occupancy rates and rental demand can fluctuate. An unconventional cash flow profile is a series of cash flows that, over time, don’t go in only one direction. It is characterized by not just one, but several changes in the direction of the cash flow. Directional changes are usually represented by the positive (+) and negative (–) signs. The positive sign (+) denotes a cash inflow of cash, while the negative (–) sign denotes an outflow of cash.

Cash flow from operations reflects daily business activities, whereas cash flow from investing shows acquisition or disposal of long-term assets. Analyzing these cash flows can help investors make informed decisions, reducing the fear of missing out on potential market opportunities. Conventional Cash Flow is cash flow that starts with a negative outflow, then a series of positive inflows. You must take into account the timing and size of the initial negative outflow and the positive ones to come after.

To understand the examples and applications of conventional cash flow, delve into real estate investment analysis and capital budgeting and investment decision-making. Explore how these sub-sections offer practical solutions in the assessment of cash flow in various financial contexts. Comparing different cash flows is key to understanding their unique characteristics and implications.

Non-conventional cash flows IRR, or internal rate of return, is a complex concept used to assess the present value of future cash flows for projects with non-CCFs. In such cases, the challenge lies in the existence of multiple IRRs, some of which may exceed the company’s hurdle rate, while others may not. This discrepancy introduces uncertainty and may undermine confidence in the investment, potentially leading the company to reconsider or reject the project. claiming a domestic partner as a dependent reflects only one direction in the cash flow of a company or organization. Usually, cash outflows occur only once – at the beginning of a project – after which, all cash flows are inflows. The initial outflow is, of course, the capital required for funding the project.